I was recently listening to two teachers Kim and Sarah have a casual conversation about their student loans-

Kim: “Sarah, I know you’ve got a handle on your student loans, but I’ve just given into the fact I’m going to be paying mine back until I’m 60.”

Sarah: “To be honest, I’m just doing student loan forgiveness.”

Kim: “But I heard only 1% of people that were eligible actually had their loans forgiven?”

Sarah: “Yeah, but I’m sure they’ll just figure it out once I’ve met the 10 years.”

Both these teachers were making the same mistake with their loans.

They weren’t being deliberate, and that’ll end up costing them thousands of dollars.

"If you fail to plan, you plan to fail."

Benjamin Franklin

While Sarah sounds like she might have it under control..

The truth is the real reason why only 1% of people qualified was because most of them didn’t follow the rules.

Public Service Loan Forgiveness (PSLR), is no joke.

If you miss even one of the criteria, you might as well not bother.

Kim wasn’t much better off- extending her loans over 30 years will end in her paying more the double than she should in interest, wasting thousands of dollars in the process.

I’ve see the same story unfold at numerous schools.

And the worst part it’s become normal.

Normal… to shrug off debt.

I don’t know about you but I HATE knowing I owe people money.

I struggled with this feeling, and although I made a ton of mistakes with my loans (more on that later)-

I finally got serious and paid off all my loans.

I’m here to tell you that you can do the same.

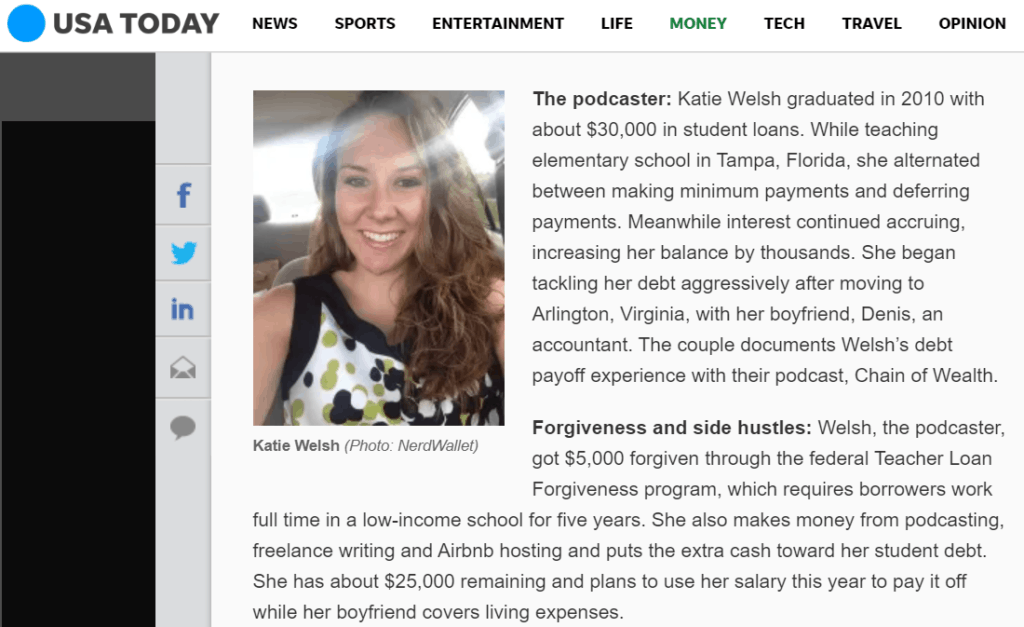

Hi, I’m Katie O’Brien.

You may know me from my top rated Podcast, Chain of Wealth on iTunes (with over 500,000 downloads), or my numerous features in leading publications like USA Today, NerdWallet and Debt.com

Although I STARTED with $30,000 of student loans, I ended up paying over $43,000.

Yeah – you read that right.

I’ve literally made all the mistakes, so you don’t have to-

The list goes on.

All this cost me thousands of dollars..

And the worst part?

I almost paid an additional $30,000 in interest.

That’s until I created my teacher student debt action plan.

I felt like such a typical millennial teacher.

I graduated in 2010, and a few weeks after I received my first student loan bill in the mail. Along with all my other bills..

Car. House. Credit Card.

Urgh!

I quickly realized that I didn’t have enough money from my teacher salary to pay them all, so I started to deferred my student loans.

Over the next 6 years I also placed my student loans into forbearance and was victim to a radio scam.

After things were going well with my then boyfriend at the time, I decided to move cross-country to Virginia (from Florida).

And then again the bills started rolling in, this time I didn’t have a job.

After he asked me how much debt I had..

..and embarrassingly I didn’t know. (Who adds up their debt right?)

We added it all up.

And it came to just under $200,000 (of which my student loan was $43,000)

I wanted to die.

Thankfully my boyfriend was an accountant, so he sat me down and explained how all the interest actually worked.

With my newfound knowledge, I created a debt action plan.

The debt action plan helped motivate me and allowed me to tackle the mountain of debt I got myself into.

I sold my house and made a small profit.

With the profit, I got rid of my bad car loan, paid off my medical bill and then all was left was my student loan.

Suddenly I felt the momentum and

Once I felt the momentum of having paid off my student loan